Breaking down the numbers in 2023, looking forward to 2024, and the Govt.'s policies and their effects.

Too long; didn't read? Here's this week's TLDRs...

2023 – a year in review

Read the article

The stats from Core Logic

Read the article

An interesting read written by Kiwibank’s chief economist Jarrod Kerr this week: the talking-points of the state of the Kiwi housing market.

Read the article

How house prices have changed, here and abroad.

Read the article

Subdued uptick in the market through November

Read the article

An investor’s analysis of regional house price movement - Ed McKnight

Read the article

How will the new govt. tackle the housing supply issue?

Read the article

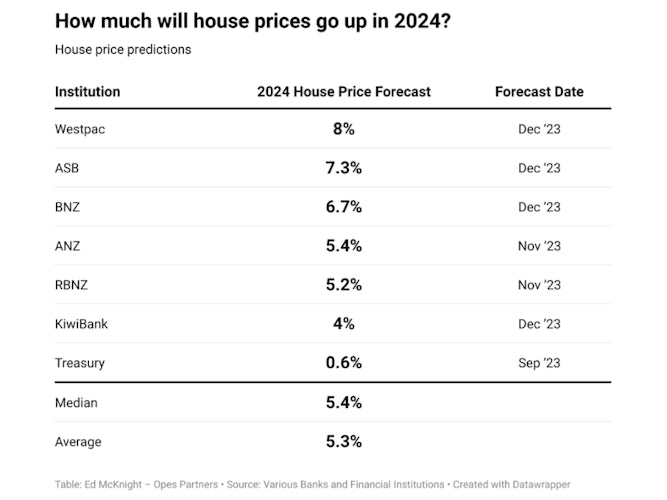

TA: A look forward to 2024

Read the article

OCR rates cuts should dominate next year

Read the article

DTIs still a possibility

Read the article

NZ’s new tax reforms are undoing the mistakes of the past

Read the article

Development group fined $133,000

Read the article

Landlord to pay $4,000 for emotional damages to ‘boarder type’ tenant.

Read the article

Aus to 3x fees on foreign purchasers

Read the article