Making $500K profit in four months, pre-Christmas mortgage rates movement, and a $38M K.O. bailout.

Too long; didn't read? Here's this week's TLDRs...

The state of mortgage debt in NZ

Read the article

Will the RBNZ raise the OCR again next year?

Read the article

Mortgage arrears have increased by 25%

Read the article

Tony Alexander on pre-Christmas mortgage rates

Read the article

Some FHBs stuck between a rock and a hard place

Read the article

Tony Alexander: Should first home buyers be worried about property investors?

Read the article

Quick report from Barfoot and Thompson

Read the article

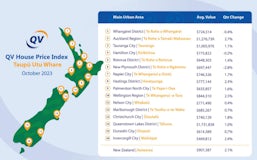

The figures suggest a subdued recovery

Read the article

Auckland’s apartment market takes a dive

Read the article

$500,000 profit via a 4-month flip

Read the article

Homeowners double their 2014 purchase price

Read the article

The infrastructure dilemma, Part 1

Read the article

The value of new building work is on the decline

Read the article

Documents reveal $37.8M bailout from KO

Read the article

Tenant left with damages bill despite not being responsible

Read the article